According to the Organic Code for Production and Investment (COPCI)[1], the Special Economic Development Zone(ZEDE) is a zone authorized by the government as a customs destination in specific spaces within the national territory to secure new investments with tax incentives.

In Ecuador, the following types of ZEDE may be possible:

- Technological: Comprises activities for the transfer and unbundling of technology and innovation;

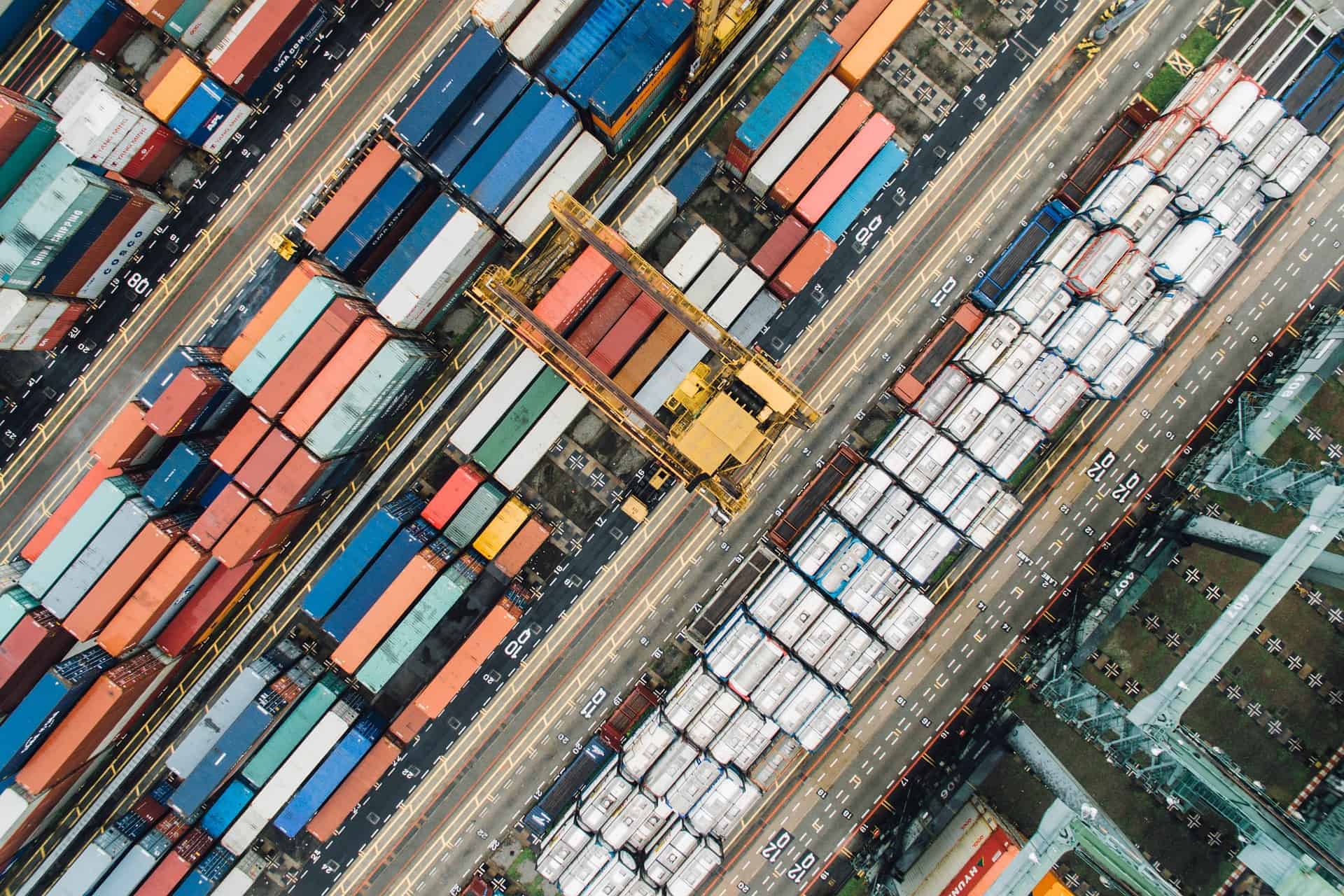

- Industrial: For industrial diversification operations including transformation, preparation and repairs of all types of goods for the purposes of exportation and strategic substitution of imports;

- Logistics: The ZEDE can be used to store cargo for consolidation, classification, labeling; management of dry ports or internal cargo terminals; maintenance and repair of ships, aircraft or vehicles for transporting goods over land; and

- Tourism Services: For the provision of tourism services, only for the development of tourism projects according to the public policy for prioritizing cantons or regions issued by the Sectoral Production Council.

The ZEDE-QUITO project, the first for the capital, was approved by the Sectoral Production Council on June 5, 2018 and aims to develop value added industrial and logistics activities in the south-east zone of Quito Airport, in an area of approx. 205 hectares. According to the time schedule that has been publicized, Quito Municipality anticipates that over the course of 2019 the companies that are interested in becoming the administrator of ZEDE-Quito will be assessed, while the certification of companies seeking to become operators in the ZEDE is expected to take place in the first quarter of 2020.

The administrator and the operators that make up the ZEDE will enjoy special foreign trade, tax and financial treatment, including these benefits:

- Exemption from foreign trade taxes.

- Import goods with 0% VAT, provided that the goods are exclusively destined to the authorized zone or are incorporated into the productive transformation processes developed there.

- Right to a tax credit for the VAT paid on purchases of raw materials, supplies and services from the national territory that are incorporated into the productive processes of the ZEDE operators and administrator.

- With the approval of the Law for Productive Development, Investment Attraction, Job Creation and Fiscal Stability and Balance, there is also an exemption from income tax and the income tax advance payment for 10 years as of the first fiscal year in which operating income is generated; as well as a 10% reduction in the income tax rate after the exemption expires. An exemption from Foreign Currency Transfer Tax on foreign payments, for both imports of goods and services related to the authorized activity and the amortization of capital and interest generated on loans granted by international financial institutions or specialized non-financial entities with a term of more than one year, for the development of investments in Ecuador (after meeting the requirements in the Law for Fair Taxation).

- In the case of ZEDE-Quito, a specific benefit guaranteed by the promoter of the project, EMPSA, is the guaranteed use of industrial land for 99 years.

It is important to carry out a detailed analysis of the transactions that the companies seeking to be part of the ZEDE-QUITO wish to carry out, since each case will have particular characteristics that will require attention in one aspect or another. If you would like more information or are interested in becoming part of the ZEDE, we will be pleased to answer any queries and offer assistance during this process.

[1]Published in the Official Register on December 29, 2010

Warning: This newsletter by Pérez Bustamante & Ponce is not and cannot be used as legal advice or opinion since it is merely of an informative nature.

Editorial Board